As the owner of a retail store, you have a lot of assets that help keep your store running. The Section 179 Tax Deduction allows US-based retailers to write off the cost of your assets to reduce your tax bill at the end of the year.

Section 179 covers hardware and software expenses too, meaning you can deduct the cost of your integrated e-commerce software from your end of year tax bill.

What is the section 179 tax deduction?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

SECTION179.ORG

Retailers that have recently purchased or upgraded to a new point-of-sale system or purchased a new e-commerce platform subscription, for example, would qualify for a section 179 tax deduction.

This tax deduction encourages store owners to invest in their business, thus promoting local economic growth. Under section 179 you can also write off equipment and software for the entire amount of the purchase.

What expenses qualify under section 179?

Any business that makes purchases for their business can claim section 179 tax deductions. Relevant expenses for brick-and-mortar stores would include:

- Point of sale hardware and software

- Integrated e-commerce software

- Computer equipment

- Office or storage equipment

- In-store technology like security cameras etc.

How do I get started?

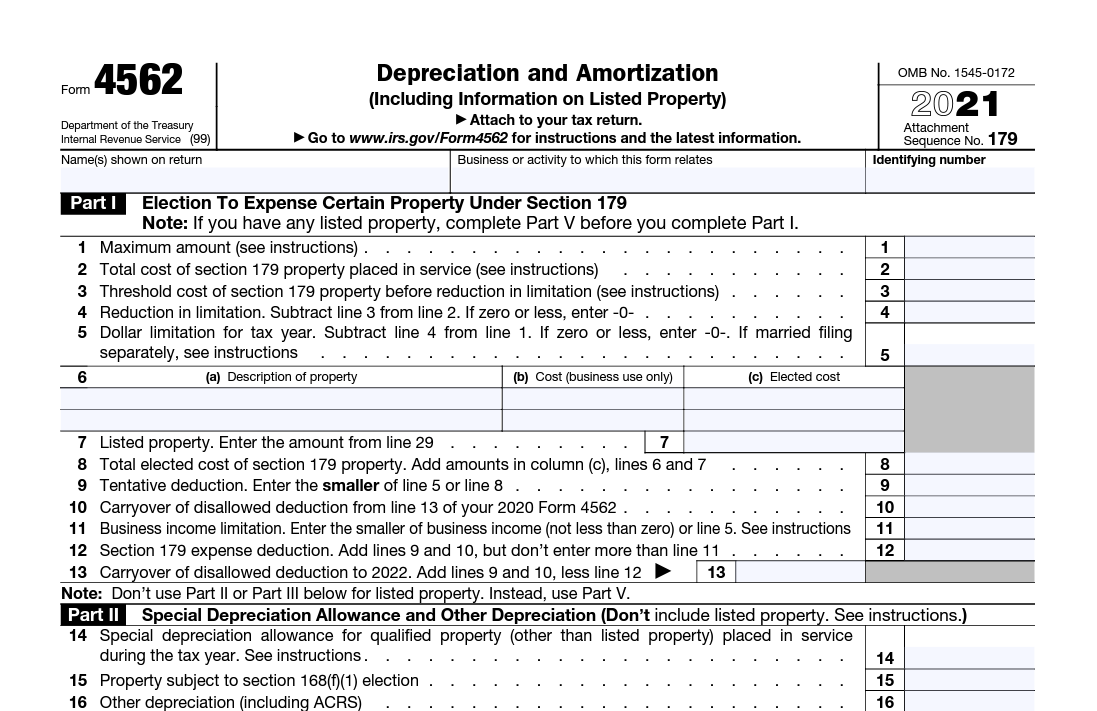

If you’ve already made a new business in 2022 that meets the criteria for section 179 then you can use Form 4562 to submit a claim.

If you’re still thinking about investing in new equipment or software for your business in 2022, then section 179 can help you reduce costs and maximize profits. As long as you purchase your new software this year, you can write it off at the end of the year.

Section 179 was created to help independent businesses mitigate the costs associated with upgrading hardware and software so they can modernize their businesses.

The deadline to submit your claim is December 31, 2022. Don’t miss out on the chance to upgrade your offline and online sales channels, and have the cost fully covered.

Read more about section 179 on the official site or request a free demo of WebSell to start your integrated e-commerce journey.

Experience true e-commerce integration

Connect your offline and online sales now. Request a demo to tour our platform and discuss pricing.

Get the latest e-commerce tips and news

-

4 Reasons Product Packaging is Important for E-commerce in 2023

Originally published September 2020. Updated February 2023. Product packaging is the final touchpoint with your customer. It’s your last line of marketing, and nailing it often means returning customers. Your packaging contributes to the success of your business more than you might think. Sure, packaging’s primary utility is to protect the product, but it can […]

-

5 Signs It’s Time for an E-commerce Website Redesign

If you own an e-commerce store, you know that the design of your website can have a major impact on your sales and customer experience. A well-designed website should be easy to use, modern, and attractive. According to a 2021 survey, 42% of people will leave a website due to poor functionality. Unfortunately, many websites […]

-

E-commerce SEO: The Complete Guide (2023)

To succeed at e-commerce, ranking higher than the competition on Google is essential. This is done through SEO. Having an SEO strategy in place means more clicks, and that means more sales. But many don’t even know where to start or what SEO even means! 😱 This guide is for you if you’re: SEO has […]